How Much Is Property Tax In Michigan . File with h&r block to get your max refund. 84 rows michigan : Press calculate to see the. to calculate your property taxes, start by typing the county and state where the property is located and then enter the home value. File with a tax pro. This interactive table ranks michigan's counties by median property. You can now access estimates on property taxes by local unit and school district, using 2023 millage rates. Median property tax is $2,145.00. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. But, rates vary from county to. estimate my michigan property tax. michigan’s effective real property tax rate is 1.64%. Compare your rate to the michigan and. the millage rate database and property tax estimator allows individual and business taxpayers to estimate their current. Our michigan property tax calculator can estimate your property taxes based on.

from www.mackinac.org

Our michigan property tax calculator can estimate your property taxes based on. the millage rate database and property tax estimator allows individual and business taxpayers to estimate their current. Press calculate to see the. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. estimate my michigan property tax. 84 rows michigan : You can now access estimates on property taxes by local unit and school district, using 2023 millage rates. Compare your rate to the michigan and. File with a tax pro. This interactive table ranks michigan's counties by median property.

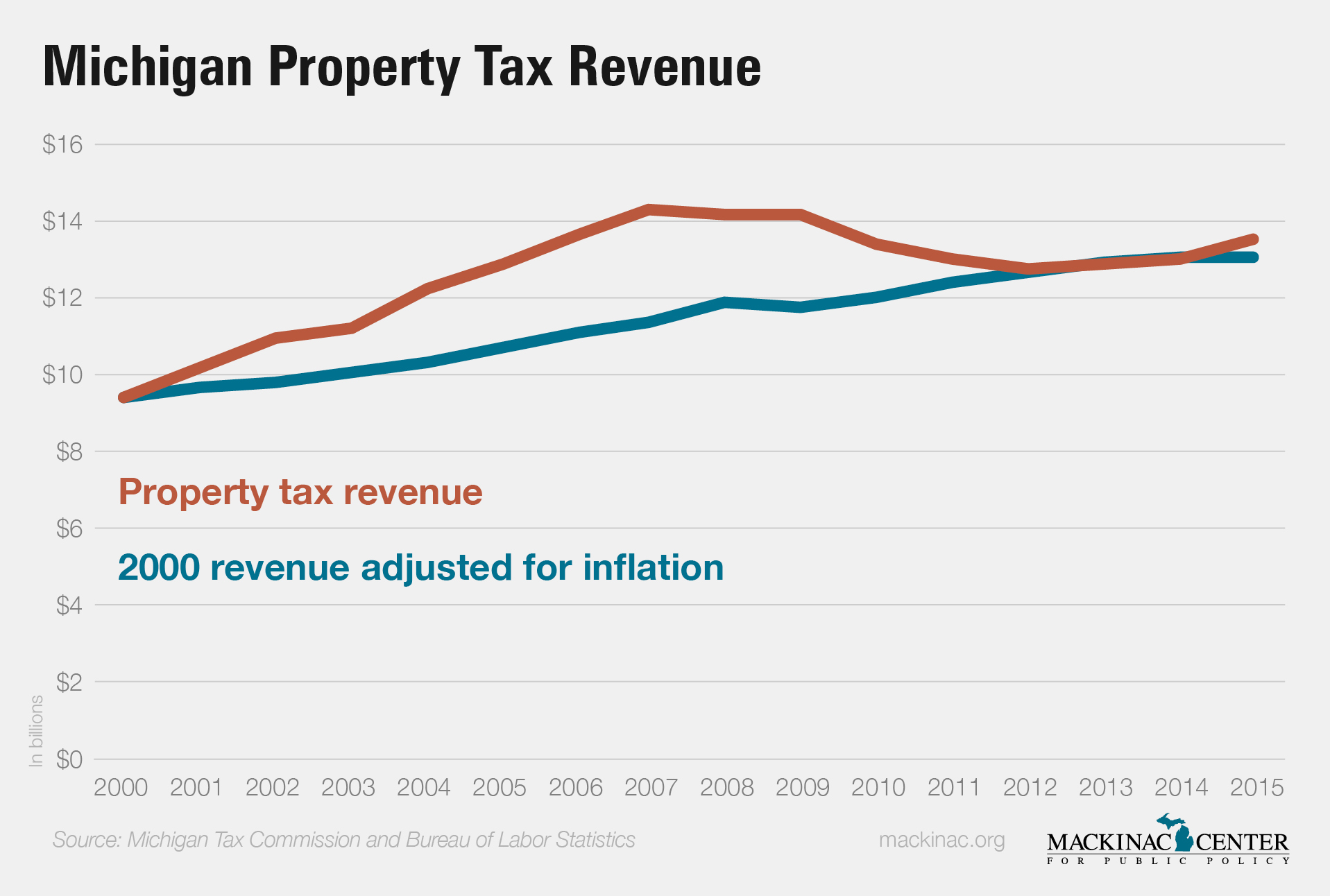

Municipal Revenues Up Despite Arguments to the Contrary Mackinac Center

How Much Is Property Tax In Michigan File with a tax pro. File with a tax pro. Press calculate to see the. You can now access estimates on property taxes by local unit and school district, using 2023 millage rates. the millage rate database and property tax estimator allows individual and business taxpayers to estimate their current. Our michigan property tax calculator can estimate your property taxes based on. 84 rows michigan : michigan’s effective real property tax rate is 1.64%. estimate my michigan property tax. File with h&r block to get your max refund. Compare your rate to the michigan and. But, rates vary from county to. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. to calculate your property taxes, start by typing the county and state where the property is located and then enter the home value. This interactive table ranks michigan's counties by median property. Median property tax is $2,145.00.

From homefirstindia.com

Property Tax What is Property Tax and How It Is Calculated? How Much Is Property Tax In Michigan File with a tax pro. to calculate your property taxes, start by typing the county and state where the property is located and then enter the home value. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. michigan’s effective real property tax rate is 1.64%. the millage. How Much Is Property Tax In Michigan.

From taxfoundation.org

Ranking Property Taxes by State Property Tax Ranking Tax Foundation How Much Is Property Tax In Michigan calculate how much you'll pay in property taxes on your home, given your location and assessed home value. This interactive table ranks michigan's counties by median property. But, rates vary from county to. File with a tax pro. Press calculate to see the. Compare your rate to the michigan and. 84 rows michigan : Our michigan property tax. How Much Is Property Tax In Michigan.

From www.drawingdetroit.com

Michigan taxes Drawing Detroit How Much Is Property Tax In Michigan michigan’s effective real property tax rate is 1.64%. This interactive table ranks michigan's counties by median property. 84 rows michigan : to calculate your property taxes, start by typing the county and state where the property is located and then enter the home value. Median property tax is $2,145.00. calculate how much you'll pay in property. How Much Is Property Tax In Michigan.

From srx-lduf6.blogspot.com

mi property tax rates Nedra Rowan How Much Is Property Tax In Michigan File with a tax pro. Press calculate to see the. But, rates vary from county to. Our michigan property tax calculator can estimate your property taxes based on. 84 rows michigan : You can now access estimates on property taxes by local unit and school district, using 2023 millage rates. This interactive table ranks michigan's counties by median property.. How Much Is Property Tax In Michigan.

From www.assureshift.in

What is Property Tax & How to Pay Property Tax Online? How Much Is Property Tax In Michigan You can now access estimates on property taxes by local unit and school district, using 2023 millage rates. But, rates vary from county to. File with h&r block to get your max refund. 84 rows michigan : to calculate your property taxes, start by typing the county and state where the property is located and then enter the. How Much Is Property Tax In Michigan.

From prorfety.blogspot.com

2018 Michigan Homestead Property Tax Credit Claim Mi1040cr How Much Is Property Tax In Michigan estimate my michigan property tax. michigan’s effective real property tax rate is 1.64%. the millage rate database and property tax estimator allows individual and business taxpayers to estimate their current. Median property tax is $2,145.00. But, rates vary from county to. File with h&r block to get your max refund. You can now access estimates on property. How Much Is Property Tax In Michigan.

From dailysignal.com

How High Are Property Taxes in Your State? How Much Is Property Tax In Michigan to calculate your property taxes, start by typing the county and state where the property is located and then enter the home value. File with h&r block to get your max refund. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. Compare your rate to the michigan and. . How Much Is Property Tax In Michigan.

From fnrpusa.com

How to Estimate Commercial Real Estate Property Taxes FNRP How Much Is Property Tax In Michigan calculate how much you'll pay in property taxes on your home, given your location and assessed home value. 84 rows michigan : Compare your rate to the michigan and. This interactive table ranks michigan's counties by median property. to calculate your property taxes, start by typing the county and state where the property is located and then. How Much Is Property Tax In Michigan.

From www.thestreet.com

These States Have the Highest Property Tax Rates TheStreet How Much Is Property Tax In Michigan Our michigan property tax calculator can estimate your property taxes based on. 84 rows michigan : File with h&r block to get your max refund. But, rates vary from county to. Compare your rate to the michigan and. the millage rate database and property tax estimator allows individual and business taxpayers to estimate their current. This interactive table. How Much Is Property Tax In Michigan.

From taxfoundation.org

How High Are Property Tax Collections in Your State? Tax Foundation How Much Is Property Tax In Michigan But, rates vary from county to. This interactive table ranks michigan's counties by median property. to calculate your property taxes, start by typing the county and state where the property is located and then enter the home value. Press calculate to see the. Compare your rate to the michigan and. michigan’s effective real property tax rate is 1.64%.. How Much Is Property Tax In Michigan.

From taxwalls.blogspot.com

Are Michigan Property Taxes Paid In Arrears Tax Walls How Much Is Property Tax In Michigan But, rates vary from county to. You can now access estimates on property taxes by local unit and school district, using 2023 millage rates. the millage rate database and property tax estimator allows individual and business taxpayers to estimate their current. Our michigan property tax calculator can estimate your property taxes based on. File with a tax pro. Compare. How Much Is Property Tax In Michigan.

From numberimprovement23.bitbucket.io

How To Lower Michigan Property Taxes Numberimprovement23 How Much Is Property Tax In Michigan Press calculate to see the. File with h&r block to get your max refund. Median property tax is $2,145.00. estimate my michigan property tax. to calculate your property taxes, start by typing the county and state where the property is located and then enter the home value. the millage rate database and property tax estimator allows individual. How Much Is Property Tax In Michigan.

From mexus.com.hk

How is property tax calculated? Use an example to teach you, how much How Much Is Property Tax In Michigan File with h&r block to get your max refund. 84 rows michigan : to calculate your property taxes, start by typing the county and state where the property is located and then enter the home value. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. You can now. How Much Is Property Tax In Michigan.

From www.investopedia.com

Property Tax Definition, What It's Used for, and How It's Calculated How Much Is Property Tax In Michigan Press calculate to see the. File with a tax pro. Compare your rate to the michigan and. You can now access estimates on property taxes by local unit and school district, using 2023 millage rates. Median property tax is $2,145.00. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. . How Much Is Property Tax In Michigan.

From www.rusticaly.com

What Is The Michigan Homestead Property Tax Credit? How Much Is Property Tax In Michigan But, rates vary from county to. Press calculate to see the. michigan’s effective real property tax rate is 1.64%. File with h&r block to get your max refund. 84 rows michigan : to calculate your property taxes, start by typing the county and state where the property is located and then enter the home value. the. How Much Is Property Tax In Michigan.

From rethority.com

Property Tax by County & Property Tax Calculator REthority How Much Is Property Tax In Michigan But, rates vary from county to. Our michigan property tax calculator can estimate your property taxes based on. estimate my michigan property tax. Compare your rate to the michigan and. File with h&r block to get your max refund. File with a tax pro. 84 rows michigan : to calculate your property taxes, start by typing the. How Much Is Property Tax In Michigan.

From www.dochub.com

Michigan homestead property tax credit instructions 2022 Fill out How Much Is Property Tax In Michigan michigan’s effective real property tax rate is 1.64%. 84 rows michigan : File with h&r block to get your max refund. You can now access estimates on property taxes by local unit and school district, using 2023 millage rates. Median property tax is $2,145.00. But, rates vary from county to. Our michigan property tax calculator can estimate your. How Much Is Property Tax In Michigan.

From taxunfiltered.com

How Much Does Your State Collect in Property Taxes Per Capita? Tax How Much Is Property Tax In Michigan This interactive table ranks michigan's counties by median property. Compare your rate to the michigan and. the millage rate database and property tax estimator allows individual and business taxpayers to estimate their current. to calculate your property taxes, start by typing the county and state where the property is located and then enter the home value. Median property. How Much Is Property Tax In Michigan.